He who controls the corn controls the universe.

If you’ve been an avid reader of Globalhalo, first; thank you! As such, you may have come across this article we posted last year that went over some of the fundamental catalysts that would take crypto to the next level, even further than where it was at the time. At the time of writing, the crypto market cap was sitting at a cool 150 Billion dollars, and there were no signs of slowing down – only, we did. Though we did enjoy an explosive 10x in market cap since we posted the piece, the 2018 crypto bear has been in full force, leaving naught but ashes in its wake since January.

Of course that is going to leave our lovely readers prone to asking great questions/comments such as “What happened to the bull run?”, “You’ll be seeing my lawyer”, and “How long can a man survive off of only Ramen?”. All of these questions and more will be answered today. But first, let’s look at what has actually been happening in the markets.

CME Futures

Remember the heydays of December? When CME Group was preparing to launch their futures trading instrument for Bitcoin? Those were the days – indeed, it all seemed to be lining up perfectly for the crypto community when it came to things like mainstream acceptance. Getting a futures contract on an exchange like the CME meant that big players were finally taking Bitcoin (and crypto) seriously. At least, that was the dream that was sold to investors.

Never mind that we were quickly approaching parabolic levels of price discovery for crypto, Bitcoin was trading at just shy of 20 grand per coin, and there were absolutely zero fundamental or technical aspects to be able to maintain said price. In short, most of the community got taken completely by surprise when it turned out that the institutional investors we had been waiting for would short an asset that was priced so ridiculously. I mean, does anyone else remember paying 20 dollars for a Bitcoin transaction? It was a massive retail bubble, and someone needed to put the kibosh on that.

Your loyal writer was also expecting some kind of insane dump at some point – since the writing of the article we grew from 150 billion in market to over 1 trillion at its peak, and it was clear that there were no developments underneath the hood to truly justify that price.

Massive Paper Volume

So the futures started trading. And wouldn’t you know, it turns out that wall street was ready to dump our precious coin to the ground, shucking the unstable layers of retail investors and FOMO VC’s, and giving everyone a lesson in humility. Yes, the asset dumped. And then it dumped. And then it continued to dump. In fact, paper trading volume for CME was so high there were billions of dollars being traded in contracts every single week; we can guess that these were all short positions of course, possibly hedged by spot buying Bitcoin during the massive dumps on the retail markets.

“But Soros is entering crypto!”, you might say. Well, dear reader, think of yourself being in the position of a whale like Soros. You single handedly destroy the economies of small countries, have a nearly infinite stack to trade with, and lots of time (as evidenced by that age!). Of course you wouldn’t enter at 20 racks. Why would you do that when you could short the futures, create a bearish narrative, and bleed the market as low as it can go before you truly start loading up on your chosen asset?

Of course, no one can truly know what the billionaire play book is for these kind of things – one can only guess. But with all of the recent audits of exchanges such as Bithumb, more unsubstantiated tether FUD, and the Mt. GOX trustee openly market dumping, fear has certainly taken hold of the poor retail traders who leveraged in near ATH levels. Ah, but there is always a turn. In this case, we’re talking about a complete market reversal that we at GH are expecting to happen in the near future. Why is that?

Whales Finally Entering

So we know that retail money can’t be trusted – after all, they are the reason we have gone to such parabolic heights (thank you for the gains though!) in such an unstable manner. Who can we truly trust then? The answer is the same it has always been – the strong hands.

When prices are dumping in such an extended bear market, you need to look for the critical support that whales and strong hands are likely to buy in. And we’ve started to see signs of that kind of activity. Whether its the recent Bullwhale on Bitfinex, large wallets reaccumulating, or the insanely bullish Bakkt deal that ICE is funding, things are looking a hell of a lot better on a fundamental level with Bitcoin at $7’000 than 9 months ago with none of this support and Bitcoin at $20’000.

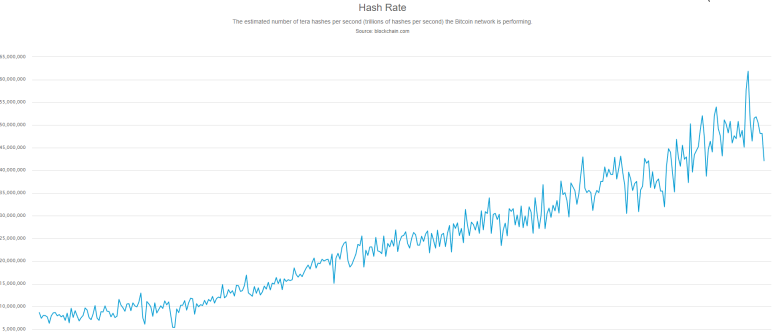

It shows that the market has now gone low enough that strong hands are feeling compelled to rebuy, which makes a lot of sense given the many bounces we’ve had around the yearly support lows. Things are even looking like they’re in a sideways accumulation range, which can only be proceeded by a future rise in price. Hashrates, as always, have been on the rise as well, with Bitcoin hashrates almost five times higher than they were back in January – miners are absolutely not slowing down at all, and in fact increasing their mining exposure, making the network that much more difficult to take down.

ETFs Are Coming

The current hype is ‘Exchange Traded Funds’ or ETFs. This will allow large investment funds to use assets they are holding (large ones) to trade in crypto as an asset class. The hype and FUD/FOMO over this has been pretty much the same as it was for futures in January, and largely for the same reasons. The fact that this will allow large scale entry of funds is not disputed, so the only real question is actually when these will go live.

ETFs have three main components – assets, infrastructure and custodial mechanisms (insurance and security etc.). The first two components have been in place for a while now but the last one, that of custodial infrastructure and mechanisms was always going to be the piece that took the longest and that is mostly in place from a technical perspective.

So the only thing left is regulatory approval.

As we have been seeing, the SEC is adopting a so-called ‘light-touch’ approach (in its own words) and there are currently nine proposals in the pipeline in terms of applications submitted. There have been numerous delays and deferrals, and a memorable balls-up a week or 2 ago when an application was denied then deferred within 48 hours (still not 100% sure what caused that, but there are lots of theories), but make no mistake – this is just a matter of time.

The first ETF(s) may be here at the end of this month, but definitely by February at the latest and the grapevine at the SEC and at Wall Street is very positive so this influx of funds and clout WILL happen. Regardless of that the market has recently shown good signs of revival.

Conclusion

Things have been tumultous at best, and completely hopeless at worst. Market capitulation has happened for things like alts some time ago, and many of the retail traders are liquidated or back to their regular jobs by now. This is now the perfect time for institutions to get in. Wall street is accumulating. Big funds are accumulating. Even crypto legends like Secrets and Cobain are starting to re-accumulate positions. It’s only a matter of time until things turn around – and likely soon.

Halo out.